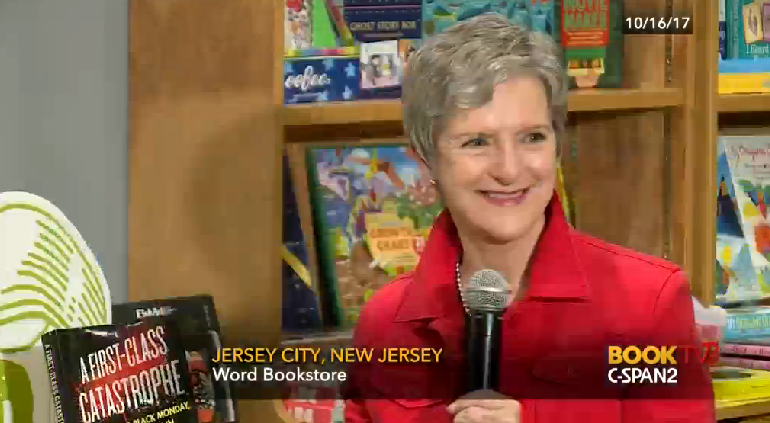

Diana Henriques, financial journalist and author of “A First-Class Catastrophe,” discusses how Monday’s market meltdown compares to other financial crashes.

Diana Henriques, financial journalist and author of “A First-Class Catastrophe,” discusses how Monday’s market meltdown compares to other financial crashes.

“Ms. Henriques’ extensive investigative reporting on white-collar crime, market regulation and corporate governance gives her unique insights and perspective,”

More info here.

“The simple truth was that financial institutions could no longer be allowed to fail — the links among them were [in the words of Longstreth] ‘simply too extensive to prevent one failure from triggering another.’”

Read the full article here.

One of the most challenging things I’ve done lately was to prepare, memorize, and deliver a TEDx talk at Yale earlier this month. Called “Trust, Lies and Bernie Madoff,” it explores the paradox of trust. Trust is both a nourishing, enriching part of life and an essential element of a healthy economy and a healthy society. BUT it is also “the only weapon a con man needs to destroy his victims’ lives.” How should we navigate the dual nature of trust when we handle our money? See my suggestions in the video above.

HBO’s Wizard of Lies is back in the news with nominations for both the Golden Globes and the Screen Actors Guild awards!

Golden Globes full nominations here.

“Henriques notes the crash was actually seven years in the making, and she also demonstrates how it was the predicate to the financial crisis of 2008. Sadly, investors, regulators and bankers failed to heed the lessons of 1987, even as the same patterns resurfaced.”

Read the full article here.

Diana Henriques talked about her book, A First-Class Catastrophe, about the worst day in stock market history. On that day, October 19, 1987, the market lost 22 percent of its value. She spoke with Bloomberg View columnist Joe Nocera.

See the video.