I appeared on Money Life with Chuck Jaffe (moneylifeshow.com) to discuss the new book and more.

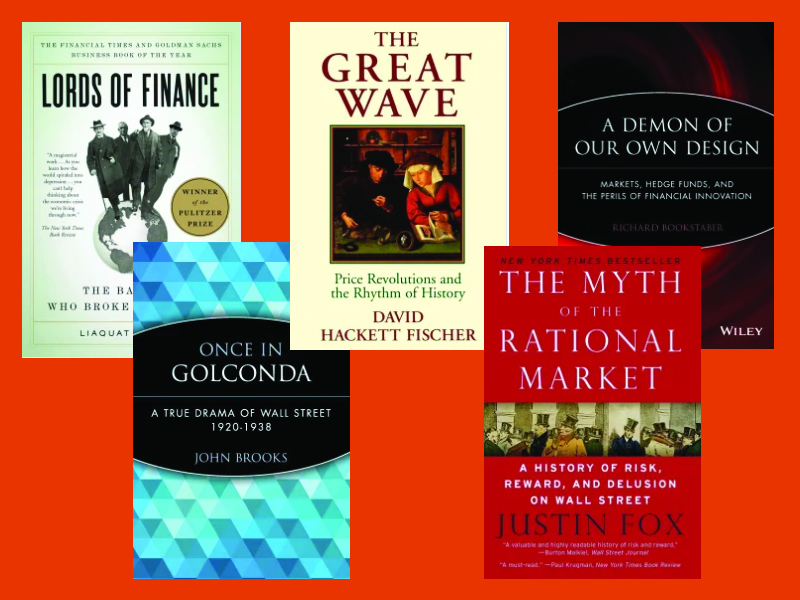

I was recently asked to list some of the books I think are the best for understanding past markets and their relationship to what is happening today. See the full article here.

Diana Henriques, financial journalist and author of “A First-Class Catastrophe,” discusses how Monday’s market meltdown compares to other financial crashes.

“Ms. Henriques’ extensive investigative reporting on white-collar crime, market regulation and corporate governance gives her unique insights and perspective,”

More info here.

“The simple truth was that financial institutions could no longer be allowed to fail — the links among them were [in the words of Longstreth] ‘simply too extensive to prevent one failure from triggering another.’”

Read the full article here.

“What worries me about this is it completely ignores the way our financial system actually works. No bank is an island in today’s world, regardless of its size. Midsize banks sell their loans upstream. They form syndicates that take on bigger risks. They provide critical lines of credit to big local industries that are big employers, so they’re connected to the larger economy in dozens of ways we may not even see until the dominoes start to fall.”

Read the full article here.

Diana discusses the lasting lessons from Black Monday – the biggest drop in Wall Street history – and the relevance in understanding today’s markets, along with insights from her extensive reporting on the Bernie Madoff scandal. Part of the Talks at GS series of Goldman Sachs.